What is EBITDA and Why Does it Matter? EBITDA is a financial metric that provides a clear picture...

Amortization

Finance amortization is an essential concept that significantly affects not only businesses but also the majority of individuals who invest in real estate or any other physical or non-physical asset. When you really think about it, amortization directly affects anyone with debt, or borrowed money in the form of a type of loan or credit - credit cards, mortgage, car loan, business loan, construction loan, etc.

Understanding Finance Amortization

Finance (debt) amortization is the method of systematically repaying a loan over time through regular, scheduled payments. In real estate, it mainly pertains to the process of repaying a mortgage on a property. Each payment comprises two key components: principal and interest.

-

Principal: This portion of the payment directly reduces the loan amount. As payments are made, the principal balance diminishes, and your ownership stake in the property (Equity) grows. When you invest in an income producing Real asset - Multi-family or single residence - your equity grows without you paying the principle down, because the tenant pays it for you! (that is the plan anyway..)

-

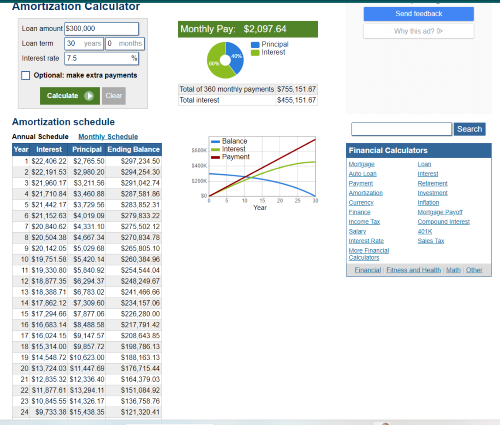

Interest: Interest represents the cost of borrowing money. A portion of each payment goes towards covering the interest on the outstanding loan balance. This is what most people don't fully grasp. As an example: If you buy a house, with 7.5% interest (cost of debt), 30 year loan, $300K, only pay the minimum payment each month, YOU END UP PAYING OVER $755k AT THE END OF THE 30 YEARS!!!!

Ways Amortization Affects Your Apartment Syndication Business

-

Equity Building: Amortization helps build equity in your real estate investments, a tangible asset. As you (your tenants) make mortgage payments, you incrementally increase your ownership stake in the property.

-

Predictable Cash Flow: Fixed-rate mortgages offer the predictability of consistent payments, which is crucial for managing your apartment syndication business effectively and projecting your cash flow. Even when interest rates are high, fixed-rate debt will traditionally be your friend.

-

Tax Benefits: The interest portion of mortgage payments is generally tax-deductible, offering potential tax advantages for your tangible asset investments. Real Estate has so many amazing tax benefits to take advantage of, this is just one of them. Tom Wheelwright has a great book - Tax Free Wealth - that goes into these a bit more, I highly recommend reading it.

-

Improved Leverage: Paying down your mortgage allows you to leverage your equity for the acquisition of more properties, thus expanding your apartment syndication business.

Intangible Asset Amortization - This amortization is actually good for the debtor.

Intangible assets, in the context of real estate, typically refer to non-physical assets like patents, trademarks, or branding associated with a property. Amortization in this context is the gradual expensing of these intangible assets over their useful life. It's an accounting method aimed at reflecting the true economic reality of the investment. As an example: You bought a restaurant business including branding, recipes, systems, etc. Those recipes, and other intangible assets have value, and you can protract the expense of that value over time to reduce your tax liability each year. Read the above mentioned book.

The Impact of Interest Rates on Real Estate

Interest rates also play a significant role in any debt taken on personally or for a business.

-

Mortgage Rates: Interest rates directly influence mortgage rates. Lower rates make it more affordable for investors to acquire properties, increasing demand and possibly impacting property values. You cannot deny the law of supply and demand.

-

Property Prices: Interest rates can influence property prices. Low rates might drive up prices, while high rates could exert downward pressure on valuations.

-

Financing Costs: Your financing costs, whether for tangible or intangible assets, are closely tied to interest rates. Lower rates result in lower monthly payments and improved cash flow. Conversely, higher rates may affect profitability.

-

Investment Decision-Making: Interest rates can sway investment decisions. Lower rates may make real estate more appealing compared to other investments, while higher rates could favor alternative options. There is quite a bit of thought and research done in the area of Behavioral Finance which purports to explain decisions made by most people in the market, and may be something to look into.

-

Economic Factors: Interest rates are influenced by economic factors, including inflation (ever heard of it?..) and monetary policy. These elements have widespread effects on the real estate market, whether in terms of tangible or intangible assets.

Finance amortization assists in building equity in tangible assets, offers predictable cash flow, and can provide substantial tax benefits. Intangible asset amortization, on the other hand, helps accurately reflect the economic reality of your intangible assets. Interest rates are pivotal, influencing property prices, financing costs, and investment choices, whether involving tangible or intangible assets. Staying well-informed and adaptable in this ever-evolving environment is the key to success in the real estate market, whether you're managing a syndication business or making individual investments. Understanding the mechanics of amortization, its implications, and interactions with interest rates is vital for creating a higher likelihood of success in any financial venture, especially if you take on debt. Which let's be honest, we LOVE debt, so you will most likely utilize this information at some point.